Britain needs more money, Rishi

15th October 2020 – We need to face facts: COVID-19 isn’t going away any time soon.

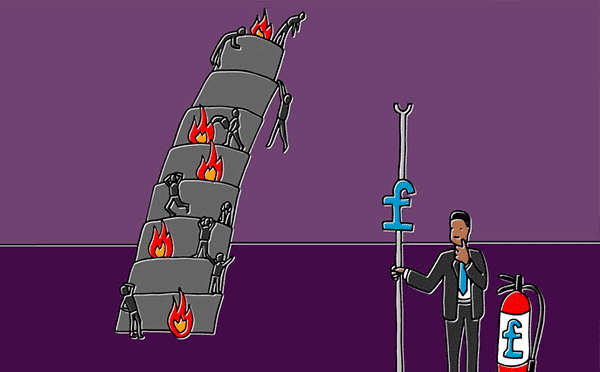

The UK is hurtling towards another lockdown and who knows what new horrors lie in store for us in 2020 and beyond. This isn’t the time to grip the purse strings and worry about the national debt. It’s time to act, borrow more money, and make sure we are propping up the businesses, industries and livelihoods that underpin our economy, our culture, and our heritage here in Britain.

The UK’s national debt currently stands at more than £2trn: 100% of our GDP. It’s easy to look at a figure like that and worry about the economic health and future prosperity of our great nation. But here’s the thing: we are all in the same boat. Earlier this year, Germany forecast that it would take an extra trillion euros to prop up its economy. France’s national debt is forecast to hit 115% of GDP by the end of this year. The idea that we, as a country, could be penalised for taking on more debt is a fallacy. If our credit rating suffers then so will the ratings of our neighbours in Europe and beyond. The only economy that is booming right now is China.

The UK’s furlough scheme is coming to an end at the end of this month. The Job Support Scheme that is replacing furlough will pay a maximum of 67% of people’s wages at the companies that have been forced to stay closed because of COVID. This is unacceptable. The government should be paying 100% of those wages; these people do not deserve to be left financially devastated because of events totally beyond their control.

The various support packages that the government has created consistently fall short. Those forced to self isolate after coming into contact with the virus can only claim £500 towards their loss of earnings. It’s a joke.

While writing this blog, I saw a post by the International Monetary Fund, warning that the withdrawal of fiscal support at this time would derail the UK economic recovery. The IMF’s Director of Fiscal Affairs, Vitor Gaspar , said: “There is too much saving, too little investment. In times of uncertainty like the ones we live in, the Fiscal Monitor argues that public investment promotes private investment, employment and growth. It also helps with the transition to a new growth model, a growth model that is resilient, smart, green and inclusive.”

I’m not saying all this because I’m trying to access any support from the government. We are extremely fortunate at BigChange that we are on a sound financial footing and the small number of people that were furloughed are now back working from home.

Meanwhile, local authorities across the UK are fighting to deliver essential services and help their communities survive this crisis. Yet they face severe cuts as the government tries to claw back cash. Here in Leeds, a thriving economy that has grown 28% over the past decade, contributing more than £26bn to the public purse, we are facing the closure of a number of public sites and facilities because the council can no longer afford to run them. Two care homes could be forced to close their doors. Around 600 council jobs will be cut because of the funding shortfall.

Tim Riordan CBE, the chief executive of Leeds Council, has written a letter to Central Government, asking the Secretary of State, Robert Jenrick MP, for more financial support to ensure the city can bounce back once this crisis passes. He writes that many of the projects that have contributed to the success of the city are “under threat” because of cutbacks. I am proud to say that I am one of more than 100 business leaders who have signed this letter. I’m in great company, standing shoulder to shoulder with Virgin Media, ASDA, Burberry, and Leeds United.

We all need to start putting pressure on government to do what’s right and support the people and organisations in financial distress this winter. Many people across the country face financial destitution. Their savings are exhausted. Businesses are at the end of their cash buffers. Now isn’t the time to dwell on the size of the national debt but to think how we can preserve the vibrancy of our economy, keep jobs and prevent a great depression. Let’s get spending, Rishi.